Ratio Analysis and its formulas are very important for any Accounts or Finance Student. But before plunging into the various ratios i.e. comparing of one element in terms with another, let me discuss few terms in Finance which has always kept me rolling my eyes while learning it.

These terms seem similar with very little change or no change at all i.e. different names for one term.

Note: One more thing is that Accounting and Managerial Accounting will have little difference in the formulas and I am going to focus more on the Management Accounting. So if you find more detailed formulas elsewhere then don’t scratch your head as it is probably accountancy formulas.

Here we go

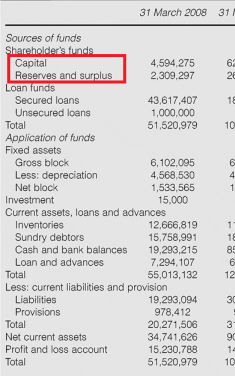

1. Owners’ Fund / Net Worth / Shareholders’ Fund/ Proprietor’s Fund

All of these are same. Thank God!! It shows the value or worth of the owners or the shareholders of the company after deducting all the liabilities.

*** When we talk of TOTAL LIABILITIES it doesn’t mean the whole Liability side of Balance Sheet but it means the whole Long term and Short term Liabilities.

1) Total Assets – Total Liabilities OR

2) (Equity+ Preference + Reserves and Surplus) OR

3) (Equity+ Preference + Reserves and Surplus)- Misc/Prelim Exp

2. Owner’s Equity / Shareholder’s Equity

It is what is available for the Equity Shareholders

Shareholder’s Fund – Preference Shares – Pref Dividend

3. Proprietary Ratio / Equity Ratio / Net Worth Ratio/ Shareholders’ Equity Ratio

This ratio shows the capital structure of the company. It is used to see how much of the Asset is contributed or invested by the capital (in percentage). Higher rate is considered risk free or better. Extreme high would also be considered inefficient usage of debt financing

Formula:

1) (Shareholders’ Equity / Total Assets ) x 100

2) (Shareholders’ Equity / (Total Assets- Intangible Asset) ) x 100

Example: If Equity Ratio is 60% then 60% of the assets of the company is contributed by Equity rest from other capital and/or borrowed funds.

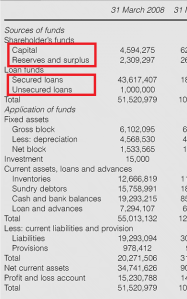

4. Capital Employed

Capital Employed is to see how much capital is invested by the company to reap the profits or for the working of the company

1) Total Asset – Current Liabilities OR

2) Shares Capital + Long Term Loans – Misc Exp OR

3) Fixed Assets + Working capital

I hope this article helped you. You can give your feedback and even rate the post now. Thankyou

DRISHYA.V.P

CHECK OUT THIS LINK TO LEARN THE SECRETS OF SUCCESSFUL TRADING